Let’s face it. Investing looks cool when your portfolio is all green, but staying consistently profitable? That takes a bit of homework, a pinch of discipline, and a good eye for fundamentals.

Here are some investing rules that have helping me stay sane and grow my portfolio steadily, even when markets acted like a moody teenager.

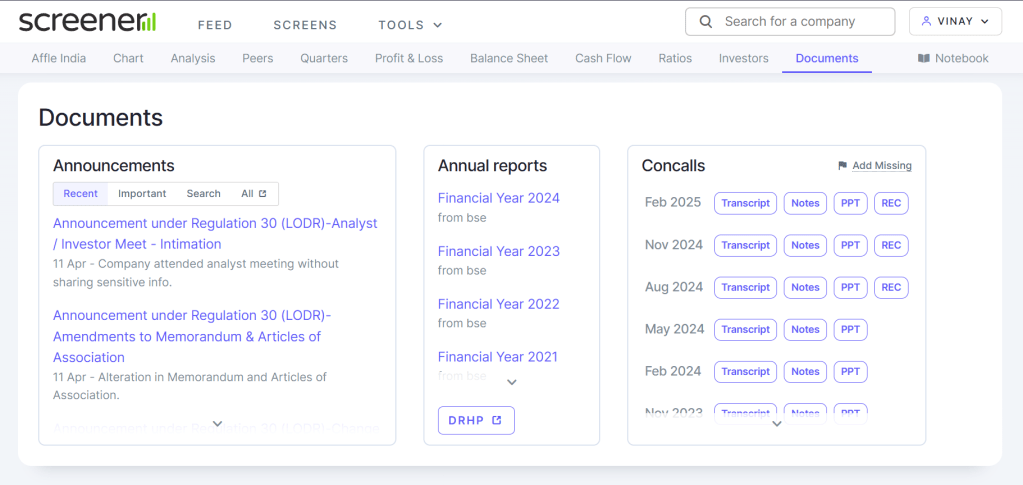

Read the Damn Concall

Before you get tempted by a trending stock or a flashy YouTube thumbnail promising “Next Multibagger,” do this:

Go to the company’s Annual Report. Read the Management Discussion and Analysis.

Even better? Catch the quarterly concalls. Use tools like Screener.in. You can download concalls transcript from there. Concalls tell you what the company is actually planning, not what influencers are hyping.

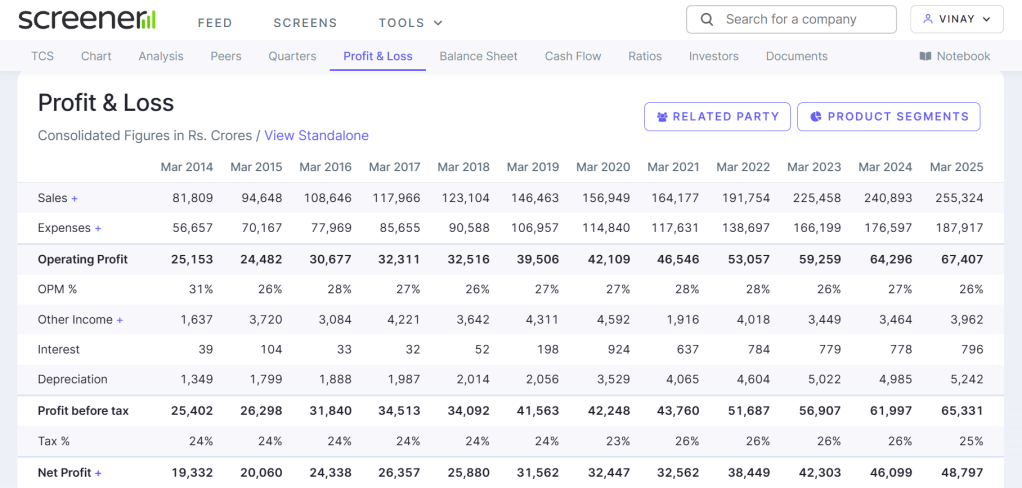

The company’s financial data are goldmines for more context on how company is really doing. Make sure company is consistently growing in terms of revenue and Profits.

Avoid Stocks With Sky-High PE (Unless You Love Pain)

If a stock’s Price to Earnings ratio is flying at 200 to 400+, ask yourself if you’re investing or just buying FOMO.

PE ratio = stock price divided by the company’s earnings per share.

It tells you how much people are willing to pay for each rupee of the company’s profit.

A high PE means the stock is priced for big future growth. But when the hype fades or growth slows, these stocks often crash harder than your New Year resolutions.

Valuations matter. There’s a reason even the best businesses crash when priced like they’ll change the world every quarter.

Believe in the India Story (But Don’t Be Blind)

India’s massive population and growing consumer base mean we’re just getting started. There’s still a long runway ahead… more people entering the workforce, rising incomes, urban expansion, digital adoption. All of it signals economic progress in motion.

And that’s the opportunity. We’re not just spectators; we can ride this growth if we pick the right players.

But don’t get carried away. Just because a company has “India” in its tagline doesn’t make it invest-worthy.

Do your homework. Compare revenue, profit margins, debt, and ROE. Let fundamentals guide your bets… not blind optimism. Also, don’t marry your stocks. Winners change. Rotate when the data tells you to.

Winners Deserve Your Trust (And Your Capital)

If a stock in your portfolio has outperformed others, don’t just clap, add more. Ride the momentum. Winners often keep winning until they don’t.

Which brings me to…

Know When to Cut and Run

- Stock at all-time high for no clear reason? Take some profits.

- Company posts a bad quarter and management sounds confused? Cut your position.

This is not emotional. This is maintenance. Just like you clean your room (hopefully), you clean your portfolio.

What’s Down? What’s Cheap? Investigate It.

When everyone’s running away from an asset, that’s when you pay attention.

- Is it down because of a short-term trend or long-term trouble?

- Are the fundamentals still solid?

If yes, and the price is at a discount, go in like it’s free cake with chocolate on top.

Selling? Do It Smartly

If an asset is booming and you feel like it’s overvalued, don’t wait for a crash.

Take profits in slices. Maybe sell 10 to 20 percent of your position. This way, you secure gains and stay in the game in case it still runs.

KISS (Keep It Simple, stupid!)

Most successful investing strategies are boring.

They don’t involve 17 indicators and 9-hour screen time.

They involve:

- Knowing what you own

- Tracking performance

- Making data-driven decisions

If you’re just guessing, you’re gambling. Might as well head to Goa.

Investment Avenues for Indian Investors

Here’s where you can put your money to work:

- Indian Stock Market (Equities, Mutual Funds, ETFs)

- US Stock Market (via INDMoney, Vested, etc.)

- Gold and Silver (SGBs, ETFs, physical)

- Crypto (risky but rewarding if done right)

Each of these plays differently in market cycles. Rotate and rebalance based on trends, valuations, and your risk appetite.

Final Word

This isn’t about timing the market perfectly. It’s about building habits that stack the odds in your favor.

If you’re willing to put in the work, just like you do for your gym gains or side hustle, investing can become your greatest wealth-building engine.

So here’s a question for you:

What’s one investing mistake you wish you never made?

Drop it in the comments or shoot me a DM. Let’s learn and grow together.

Leave a comment