Every day I scroll through news feeds talking about AI breakthroughs-GPTs writing code, Midjourney generating art, AI agents planning our entire day. And yet, when I look around-step outside, walk my street, grab a coffee-everything still feels… normal.

Still see the traffic, Broken roads, Weird town planning.

That gap between what AI can do and what we see it doing in the real world? It’s because AI, for now, is trapped. It’s stuck inside screens, chips, and cloud servers. It doesn’t have hands. It doesn’t move.

But we’re closer to changing that than you think.

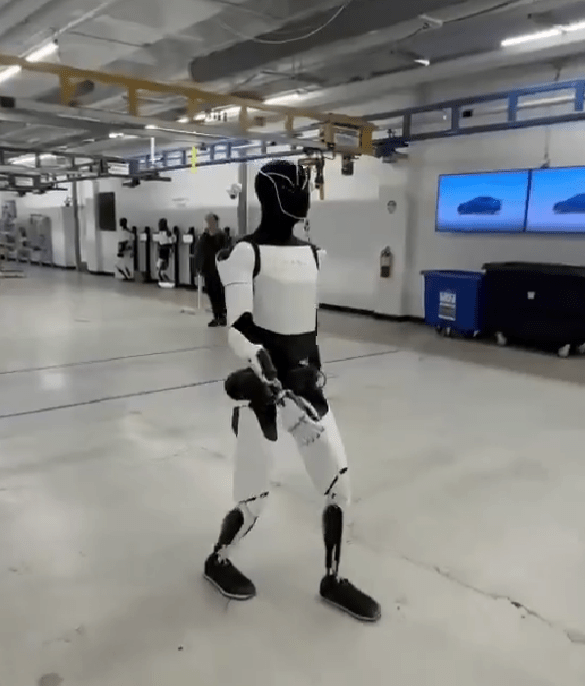

Elon Musk recently shared a video of Tesla’s humanoid robot, Optimus, trying to walk.

No, it’s not Iron Man (yet). But it’s moving. It’s learning. And what struck me wasn’t just the robot-it was Musk’s quiet announcement: Tesla is preparing to produce 10,000 to 12,000 Optimus units this year. In 2025, that could scale to 5,000 robots ready to hit the real world.

Let that sink in.

Not just AI in your pocket. But AI building your world.

Now imagine this:

- A team of humanoid robots working on road construction 24/7, without breaks or burnout.

- A squad assembling homes brick by brick-precision, speed, no human risk.

- AI-driven city planning bots laying out smarter, greener, more sustainable towns.

- Manufacturing plants where robots do the heavy lifting, literally, while humans manage, direct, and innovate.

This isn’t sci-fi anymore. It’s groundwork for the next revolution-when AI doesn’t just think, but also acts.

And the best part? It could drastically improve the quality of human life. Lower construction costs. Faster disaster relief. Safer, cleaner cities. And maybe, just maybe, help us build homes on Mars one day.

But here’s the catch-intelligence without ethics is dangerous. We don’t need a real-life Skynet. We need moral frameworks, strict boundaries, and strong governance to guide this tech. These robots shouldn’t just walk-they should walk right.

We’re entering an era where AI will leave the chat window and walk into our neighborhoods. It’s not a matter of if. It’s when. And it’s happening faster than we think.

The real question is-are we building the world we want to live in?