Another conflict. Another headline cycle. Pakistan threw its usual tantrum. We stayed calm, and this time, we showed them.

200+ drones. Neutralised overnight.

Missiles? Shot down.

Our own version of the Iron Dome? Tested. Live. Not in a lab. Not on a PowerPoint.

This wasn’t just defense. It was a product demo for the world.

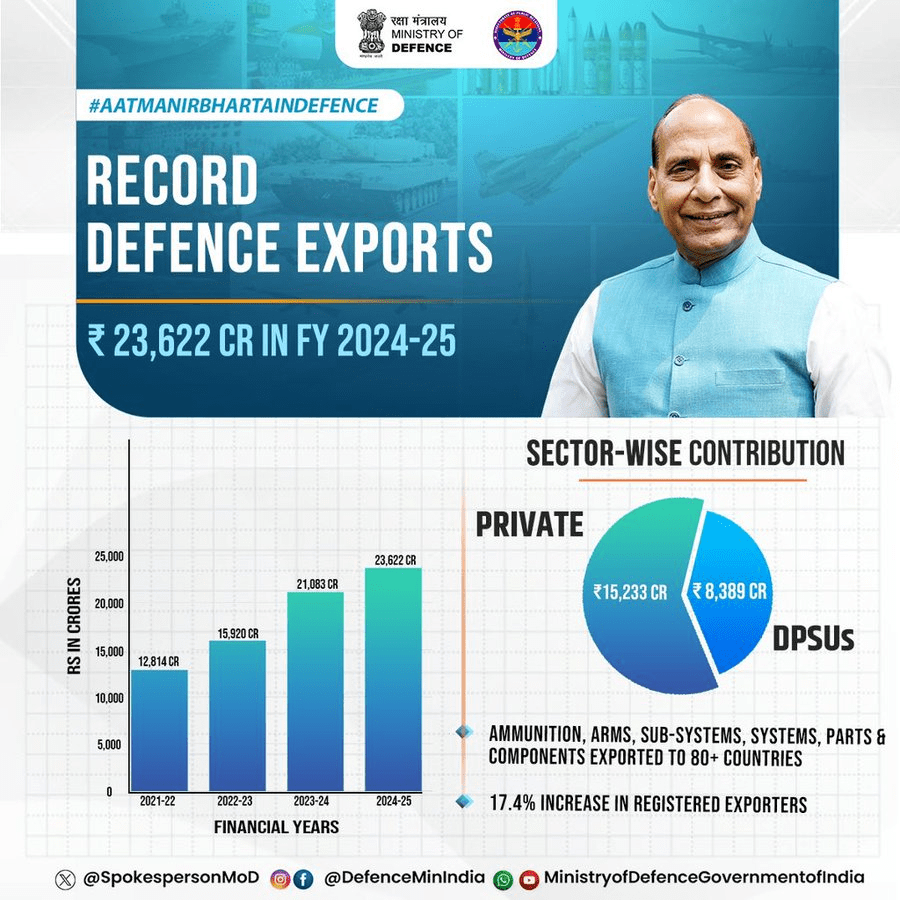

India’s defence tech isn’t just ready. It’s market-ready. And unlike China’s systems, the ones Pakistan used, ours actually work.

India’s defense exports has already got the momentum. In 2017 our defense export was around ₹1521 Crore. And now in 2025, exports are up to ₹23600 Crore.

Its poised to go up and up after this.

But here’s the thing. This war shouldn’t define us. It should wake us up. Because we already know how to handle Pakistan.

We bleed them slowly. Quietly.

“Unknown man kills a terrorist” — that’s the headline we aim for.

Keep hitting their roots till their morale hits rock bottom.

So that when the day comes, and we really announce an attack, Pakistani soldiers abandon their border posts and run for their lives.

That’s how you take down a rogue state — by weakening it from within. Not by reacting, but by outgrowing.

Pakistan is not the goal. China is.

I remember reading a line from a Pakistani journalist when our businessmen visited Pakistan for some event few decades back.

“We don’t fear India’s new weapons. We fear the day Indian billionaires land in Islamabad in their private jets.”

That’s the power we need to chase. The kind that doesn’t just win battles, but dominates boardrooms.

We don’t need another border skirmish.

We need GDP growth.

We need billion-dollar IPOs.

We need our own Nvidia, our own Tesla, our own AI giants.

Let’s not waste time chasing a neighbour stuck in the past.

Let’s build. Let’s sell. Let’s grow.

And when the world talks about superpowers in 2040, let’s make sure India isn’t just on the list. It leads it.