Every Indian investor keeps talking about SIPs, large caps, small caps, and midcaps. But hardly anyone talks about something just as important:

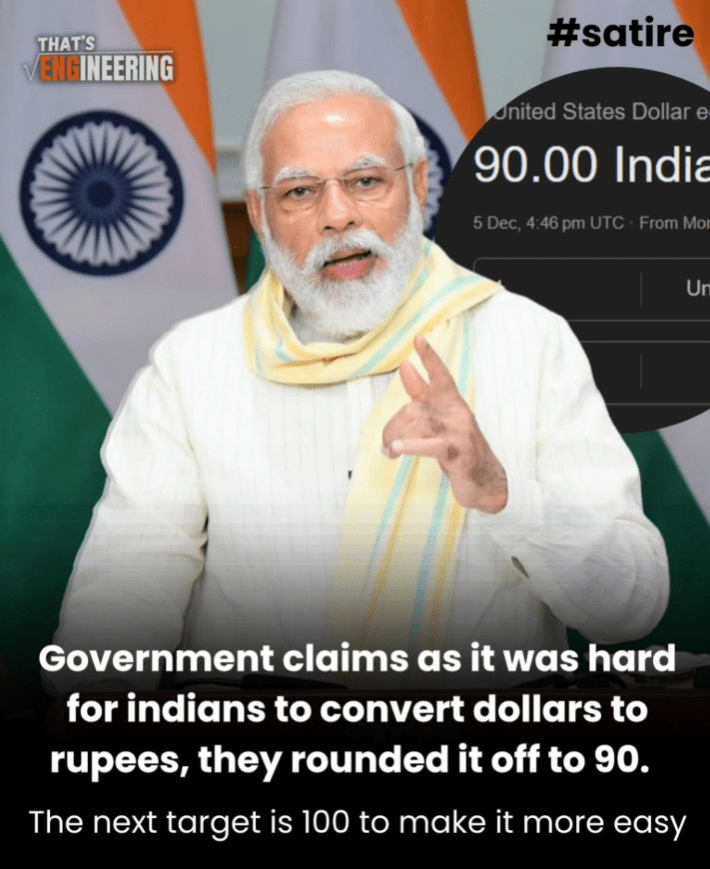

Your wealth is tied to the rupee, and the rupee keeps falling.

See the following image. This is Rupee depreciation eating into your global purchasing power. You feel rich in INR. You feel average in USD. A big reason for the current FII outflow.

This is why I’m slowly increasing my U.S. stock allocation.

Let me break it down simply.

My current split

Right now, I have around 18–20% of my portfolio in U.S. equities.

I’m planning to increase this to 30% over time.

Not in a hurry.

Not trying to time anything.

Just a slow shift.

Why?

Because your money is silently losing value when the rupee weakens.

The math nobody talks about

This year, the rupee went from ₹83.30 → ₹90.50 against the dollar.

That’s almost 7 rupees of decline.

If you had simply held USD, without touching stocks, without doing anything fancy…

₹100 worth of dollars would’ve silently turned into ₹108.

Zero effort.

Zero stock market risk.

Pure currency effect.

Your money grows without the market helping you.

Now imagine combining this with strong U.S. stocks like

Apple, Nvidia, Microsoft, Amazon, Broadcom…

You get a double benefit:

- USD appreciation

- U.S. market returns

Meanwhile, inflation in India + rupee depreciation eats away your returns here.

This is the part people usually ignore.

Not running away from India, I’m just being practical

I still invest heavily in India.

My high-conviction bets are Indian companies (you already know them).

But the rupee is not your friend long-term.

Every decade, it quietly steals from you.

That’s why I’m adding this hedge.

How I’m doing it (simple strategy)

I’m doing three things:

- Adding slowly to major U.S. tech names

- Keeping SIPs running in Indian MFs

- Rebalancing whenever things look off

30% U.S. exposure is enough to protect the downside and benefit from global growth.

The takeaway

Invest in U.S because:

- Your rupee is weakening

- Your global purchasing power matters

- USD appreciation cushions your long-term returns

- You want a portfolio that works in any scenario

A simple hedge.

A smart move.

And something we Indians should consider seriously.